Our Services

Home Inspections

Learn about your new home before you buy. A home inspection will prove both valuable and educational.

Radon Testing

The latest in radon testing technology will provide you with the data and assurance you need to maintain healthy indoor air quality.

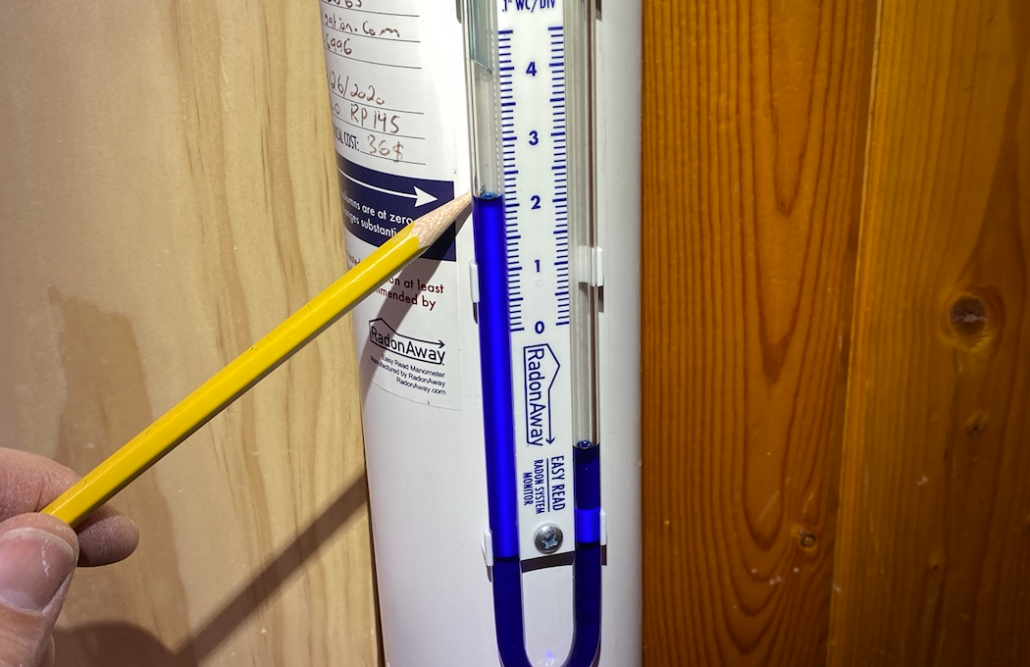

Radon Mitigation System Inspection

A 24-point inspection that determines the condition of a radon mitigation system to confirm compliance with the current ASHI Radon Standard. This is especially valuable for older systems that have not been upgraded to current mitigation codes.

Indoor Air Quality & Mold

As a Certified Indoor Environmentalist, we will provide an on-site assessment of your home in order to determine if mold or air sampling is necessary.

WDI Inspections

Protect your home from termites and other Wood Destroying Insects. Let our licensed and certified inspector certify your home is pest free.

Pre-Listing and Pre-Drywall Inspections

Improve the appeal of selling your home with a Pre-Listing inspection. Protect the final build of your new home construction with a Pre-Drywall inspection.

Water Testing

A source of clean, abundant water is an important component of any home purchase. We offer a number of water test services.

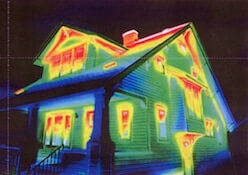

Thermal Imaging (IR)

As a Certified Residential Thermographer, we use the latest in Thermal Imaging technology to detect hidden problems that cannot be detected by a visual home inspection.